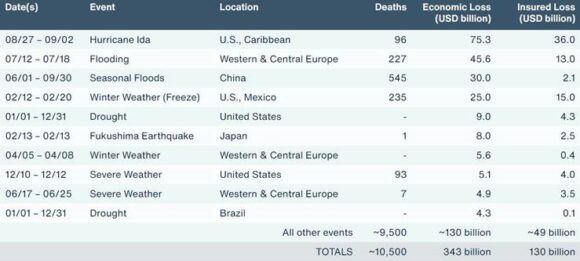

Natural disasters cost global economies a total of $343 billion in 2021, compared with $297 billion in 2020, according to Aon’s “2021 Weather, Climate and Catastrophe Insight” report.

Insured losses from 2021’s natural disasters reached $130 billion, which was well above the 21st century average ($74 billion), median ($66 billion) and 18% higher than in 2020, said Aon.

Only 38% of global economic losses were covered by insurance, which translates into a global protection gap of 62%, compared to 63% in 2020, the report continued, noting that last year’s insurance protection gap was the second lowest on record behind 2005 (60%). (The “protection gap” is the difference between total economic losses and what is covered by insurers).

The economic cost solely of weather and climate-related events — defined as events caused by atmospheric-driven phenomena — totaled $329 billion, the report said, noting that this was the third-highest loss on record for such events, after adjusting for inflation, only behind 2017 and 2005.

While the cost of losses was up from 2020, the number of notable disaster events slightly decreased, which demonstrated the heightened costliness and severity of these events, said Aon. The number of disaster events recorded in 2021 were 401, down from 430 in 2020. (See below for the criteria Aon uses to classify natural disasters).

Other key findings from the report include:

- There were 50 individual billion-dollar economic loss events in 2021, the fourth highest year on record, with only 20 of the events reaching the billion-dollar insured threshold, also the fourth highest on record. In 2020, there were 55 billion-dollar events, which was the third highest on record.

- The U.S. had a total of 23 billion-dollar economic loss events, the second year in a row with at least 20 such occurrences and only the third time on record (2017, 2020, 2021). Insured losses were 108% higher than average ($44 billion) and 227% higher than the median ($28 billion).

- The U.S., which boasts the most robust insurance industry in the world, accounted for 71% of the global insured losses. It was the second year in a row that it topped 70%.

- European floods in July were the costliest disaster on record for the continent at $46 billion.

- A key climate change factor influencing wildfire risk is the notable shift in the timing of the rainy season in California and the U.S. West. For example, California’s wet season now begins 27 days later than it did in the 1960s, said Aon, noting that this had led the California Department of Forestry and Fire Protection (Cal Fire) to declare that the term “fire season” is outdated because wildfire risk is now prevalent during the full calendar year.

- Floods in Germany, Belgium, Austria, Luxembourg recorded the costliest insurance industry events on record with losses of $13 billion.

- Floods in China cost insurers a record $2.1 billion with economic losses of $30 billion.

- 2021 marks the sixth-warmest year on record dating back to 1880.

- The year marked the latest entry into the top 10 warmest years on record. All 10 of the warmest years dating to 1880 have occurred since 2010. This includes the top five warmest years that have occurred in the past seven years: 2016, 2020, 2019, 2015 and 2017.

- Nineteen of the 20 warmest years have been registered since 2001 with the only exception being 1998 when the globe encountered one of the strongest El Niño events on record.

- The hottest temperature ever reliably measured on Earth was unofficially recorded in Death Valley, California, United States on July 9, 2021 at 54.4°C (130.0°F).

“Many global communities are exposed to increasingly volatile weather conditions that are in part enhanced by the growing effects of climate change. This includes record-setting episodes of extreme temperatures, rainfall and flooding, droughts and wildfires, rapidly intensifying tropical cyclones and late season severe convective storms,” said Steve Bowen, meteorologist and head of Catastrophe Insight at Aon, in a statement.

“We can no longer build or plan to meet the climate of yesterday. With physical damage loss costs rising, this is also leading to lingering global disruptions to supply chains and various humanitarian and other asset-related services. The path forward for organizations and governments must include sustainability and mitigation efforts to navigate and minimize risk as new forms of disaster-related volatility emerge,” he added.

“Clearly there is both a protection and innovation gap when it comes to climate risk,” said Eric Andersen, president of Aon. “As catastrophic events increase in severity, the way that we assess and ultimately prepare for these risks cannot depend on solely historical data. We need to look to technology like artificial intelligence and predictive models that are constantly learning and evolving to map the volatility of a changing climate.”

An event must meet at least one of the following criteria to be classified as a natural disaster in the Aon’s Catastrophe Insight Database:

- Economic Loss: $50 million

- Insured Loss: $25 million

- Fatalities: 10

- Injured: 50

- Homes and Structures Damaged or Filed Claims: 2,000

Photograph: Debris in a street after flooding in Schuld near Bad Neuenahr, western Germany, on July 15, 2021. Photo credit: Bernd Lauter/AFP/Getty Images

Source: Aon/Impact Forecasting

Topics Natural Disasters Profit Loss Aon

Was this article valuable?

Here are more articles you may enjoy.

The Future Is Near for Self-Driving Trucks on US Roads

The Future Is Near for Self-Driving Trucks on US Roads  Insurers Get Green Light to Pay Less Than Billed Charges in Florida PIP Cases

Insurers Get Green Light to Pay Less Than Billed Charges in Florida PIP Cases  Insurer Chubb Readies $350M Payout Tied to Baltimore Bridge Collapse

Insurer Chubb Readies $350M Payout Tied to Baltimore Bridge Collapse  Travelers to Open Technology Office in Atlanta

Travelers to Open Technology Office in Atlanta