May WASDE Report – Record Corn Crop, Increased Soybean Production Suggest Bearish Marketing Year Ahead

photo credit: Right Eye Digital, Used with Permission

The May World Agricultural Supply and Demand Estimates gives the first look at USDA’s supply and demand expectations for the newest marketing year since the USDA Agricultural Outlook Forum in February. This is the highlight of USDA’s spring reports as it incorporates farmer planting decisions from the March Prospective Plantings report and adapts supply estimates to reflect weekly planting progress reports. This Market Intel dives into the May WASDE for updated estimates of the current 2022/23 marketing year crop and looks at what may be in store for the 2023/24 marketing year, which starts in September.

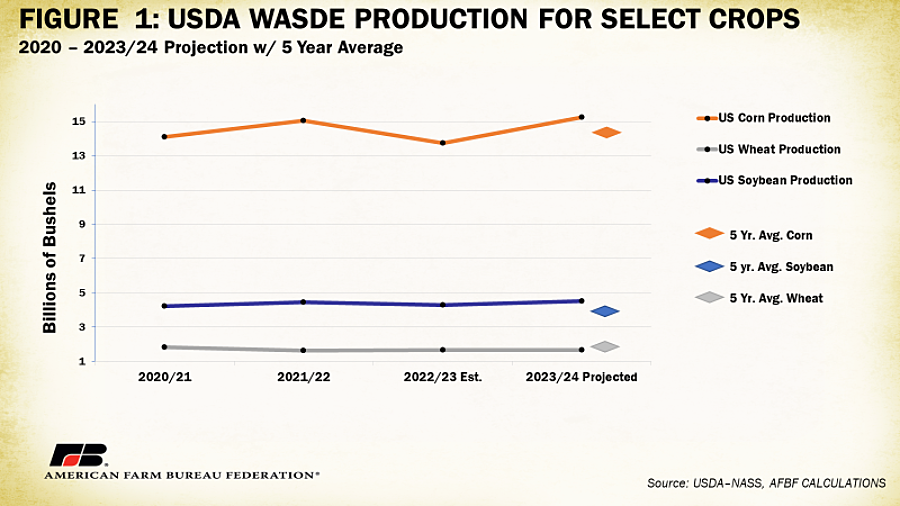

Corn

This was a bearish report for corn. USDA estimates corn planted for the 2023/24 marketing year will be 92 million acres, up 4% from 2022/23, when 88.6 million acres of corn were planted. USDA forecasts farmers will harvest 84.1 million acres of corn in 2023 with a trendline yield of 181.5 bushels per acre. This puts corn production projections in 2023 at 15.26 billion bushels, up 1.5 billion bushels, or 11%, from 2022’s 13.7 billion bushels. This would be 7% above the five-year average of 14.2 billion bushels and would be a record high. Something to consider will be how growing conditions affect yield. Higher than expected yields would make an already record crop bigger, while lower yields could bring corn back below record production levels. Both scenarios would likely result in market volatility.

On the demand side, for the new 2023/24 marketing year, USDA estimates ethanol use will be up slightly this year at 5.3 billion bushels. Corn export estimates for the newest marketing year are projected up 325 million bushels to 2.1 billion bushels, after an estimated 696-million-bushel decline this year from 2.47 billion bushels in 2021/22.

Despite lower exports and steady ethanol use, next year’s projected production decline would lead to an 805-million-bushel increase in ending stocks in September 2024, to 1.36 billion bushels. Of course, these early 2023/24 demand projections could change considerably over the next 15 months.

USDA estimates put the 2022/23 (ending) stocks-to-use ratio at 15.3%, up from the current year’s estimated 9.7%, and the highest since 2020. USDA projects the 2023/24 corn price at $4.80 per bushel, down $1.80 from this year’s estimate; this would be the lowest price since $4.53 in 2020/21, and USDA tends to be conservative when projecting big price changes. This would be a bad day to be a corn farmer if the futures market had not already built this news into prices. December corn futures reached session highs up about 6 cents at $5.19 per bushel before closing off session lows at $5.08 after the report. Traditionally, seasonal highs for new crop corn (corn to be harvested later in the year) occur between the last week of May and the first week of June.

Soybeans

Soybean farmers are expected to plant 87.5 million acres of soybeans in 2023/24, unchanged from 2022. This was up nearly 5% from 2020. Soybean yields are projected at 52 bushels per acre for 2023/24 (up 2.5 bushels from the latest estimate for 2022/23) on 86.7 million acres harvested (up slightly). As a result, U.S. soybean farmers are projected to produce 4.51 billion bushels in the new marketing year, 5% above the current year’s latest estimate of 4.28 billion bushels, and 7% above the five-year average. These are bearish numbers for soybeans.

The continuing increase in soybean production for 2022/23 follows rising crush demand to meet a rapidly rising demand for soy-based diesel fuels. Though export demand dipped in 2021/22 to 2.14 billion bushels, it is projected to fall again in 2023/24 to 1.98 billion bushels, which is above the five-year average of 1.96 billion bushels. Demand for soybeans is expected to be up 56 million bushels for 2023/24.

Production increases in 2023/24 are expected to be partially offset by increased crushings but will still drive a projected 125-million-bushel increase in ending stocks to 335 million bushels. The stocks-to-use ratio for 2023/24 is projected to be 7.6%, well above the estimated 4.8% ratio for 2022/23.

This increase in supply is projected to outweigh the small increase in demand in the new marketing year. For the 2022/23 marketing year, the average farm price for soybeans is estimated at $14.30 per bushel; and the price for 2023/24 is projected down about 15%, at $12.10.

Wheat

Wheat planted acres in 2023/24 are estimated at 49.9 million acres, up 9% from 2022/23’s 45.7 million acres. Yield is forecasted down 1.8 bushels per acre due to high levels of abandonment in Texas, Kansas and Oklahoma. The projected yield would generate wheat production of 1.66 billion bushels, a very slight increase on last year’s wheat crop, but about 7% below the five-year average of 1.79 billion bushels.

Estimated wheat demand in 2022/23 is down 2% from 2021/22, and 2023/24 demand is expected to drop another 2%, to 1.84 billion bushels, largely the result of reduced exports. Stocks at the end of 2023/24 are projected at 556 million bushels, down 7% from this year and down nearly 34% from the end of 2020/21. Feed use of wheat for 2022/23 is expected to increase by 15 million bushels in 2023/24 to 70 million bushels, while exports are anticipated to fall 50 million bushels to 725 million bushels in 2023/24. The resulting stocks-to-use ratio for wheat in 2023/24 is expected at 30.3.

USDA estimates the average farm price of wheat for the 2023/24 marketing year to be $8 per bushel, a 10% decrease from USDA’s record-high projection of $8.90 per bushel this time last year. There is a great deal of uncertainty surrounding grain movement through the Black Sea: if Russia lets the current agreement expire, grain movement by sea from Ukraine to other countries could shut down, with the potential to have a major impact on wheat prices.

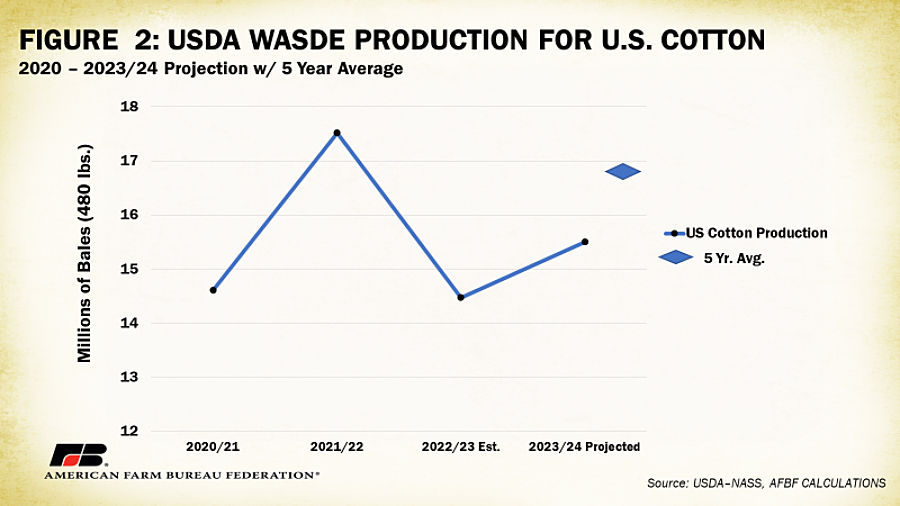

Cotton

Cotton planting expectations for the 2023/24 marketing year are 11.3 million acres, 18% below the 2022 estimate. Farmers are projected to harvest 8.7 million acres, based on historical rates of abandonment and slightly improved soil moisture in the Southern Plains. USDA anticipates a 10% yield drop to 854 pounds per acre, which brings production estimates to 15.5 million 480-lb. bales, down 5.8% from the current year and about 9% below the five-year average.

Overall cotton use, which consists largely of exports, is projected at 15.7 million bales, up about 1.4 million bales from the estimated 2022/23 use. Exports are projected to be up about 1.3 million bales, to 13.5 million bales in 2023/24.

Cotton ending stocks for 2022/23 are estimated at 4.1 million bales and USDA projects that higher production will be offset by increased exports and domestic use, leaving ending stocks for 2023/24 at 3.3 million bales, a decrease of 20%. For 2022/23, USDA estimates have the cotton stocks-to-use ratio sitting at 28.7% and the 2023/24 stocks-to-use ratio at 21%.

Higher ending stocks and increased production are expected to contribute to slightly lower prices in 2023/24. USDA projects an average price of 78 cents per pound for upland cotton, 4 cents below the estimated price for 2022/23 of 82 cents following USDA’s record projection for the 2022 marketing year, which was 90 cents per pound in last year’s May WASDE report.

Conclusions

The May WASDE is the long-awaited first look at the upcoming marketing year for corn, soybeans, wheat and cotton. There is a lot of room for changes over the coming months, but this was a bearish report, especially for corn and soybeans. USDA projected record-high production for corn, and above average production for soybeans. Strong domestic demand for wheat and tight ending stocks should provide market support. Much like last year, this May there is much uncertainty about the impacts of the Russian invasion of Ukraine on global grain and oilseed markets. Farmer planting decisions will not be updated by USDA until the June 30 acreage report and will provide more information that can be used to build expectations for the newest marketing year. Winter has just made way for spring in the Dakotas and Central Minnesota, with late snow and cool soil temperatures leading to delayed planting. These delays could result in revisions to production expectations. Any adjustments, especially in corn, could result in price variability in the 2023/24 marketing year.